Efficient risk management is the backbone of successful trading, especially in fast-evolving and volatile markets. Today’s traders require cutting-edge tools that not only keep them informed but also empower real-time decision-making with precision. axiom-trade is stepping up to meet these needs by offering advanced real-time risk management tools, ensuring better control and informed strategies for every trade.

Why Risk Management Matters in Trading

The financial markets are unpredictable by nature. With price fluctuations happening in milliseconds, traders need to assess risk quickly and mitigate potential losses. Poor risk management often leads to unforeseen financial strain, leaving traders vulnerable to the unpredictable.

Statistical studies have consistently shown that traders who incorporate robust risk management strategies tend to maintain higher profitability over time. Tools designed for real-time management, like those provided by Axiom Trade, offer traders the edge they need to succeed in such a rapidly changing environment.

Axiom Trade’s Real-Time Risk Management Arsenal

Axiom Trade combines state-of-the-art technology with user-friendly interfaces to deliver powerful tools for traders. Its real-time risk management suite ensures that users can react instantly to market changes. But how does it work?

1. Dynamic Monitoring for Immediate Insights

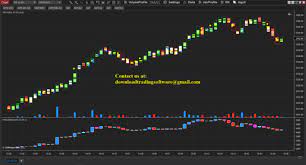

Axiom Trade’s tools enable dynamic tracking of key performance indicators (KPIs) such as drawdowns, leverage, and trade exposure. This instant accessibility translates into actionable insights for traders, helping them stay one step ahead.

2. Customizable Risk Thresholds

Not all traders have the same tolerance for risk. Axiom Trade allows users to set personalized risk thresholds, offering alerts and recommendations when these limits are breached. This level of control ensures traders remain aligned with their broader financial goals.

3. Integrated Analytics for Data-Driven Decisions

Data is the kingpin of trading, but without the right analytics tools, data is just noise. Axiom Trade provides comprehensive insights by analyzing past performance, market trends, and trade-by-trade breakdowns in real time. It equips traders with valuable statistical clues to refine their future strategies.

4. Automated Safeguards

The platform’s automation feature acts as a safety net for those situations where manual intervention may not be fast enough. By implementing pre-configured stop-loss orders or reducing leverage automatically, Axiom Trade helps safeguard portfolios from severe downturns.

Enhancement Through Innovation

What sets Axiom Trade apart is its emphasis on innovation and adaptability. They continuously refine their features to stay relevant in evolving markets. For instance, following increased volatility in the cryptocurrency space, Axiom Trade adapted its risk management tools to cater to this highly dynamic asset class. These adjustments allow clients to stay confident regardless of which market they operate in.

Studies in trading behavior also shed light on the importance of temperament. Traders often succumb to emotional decision-making, particularly during high-stress moments. Tools that offer real-time feedback, like those provided by Axiom Trade, ensure that decisions are based on logic, statistics, and viable strategies rather than emotion or impulse.

The Way Forward with Real-Time Control

The trading world no longer rewards those who solely rely on instinct or outdated techniques. To thrive in today’s environment, having access to real-time data and actionable insights is essential. Axiom Trade’s real-time risk management solutions empower traders to maintain control, minimize losses, and maximize rewards.

By investing in smarter tools like these, traders are not only reducing their exposure to risk but also positioning themselves for sustained profitability. With Axiom Trade at the forefront of this revolution, the future of managed trading is here. Stay informed, stay prepared, and trade smarter.